Geoff Huston has published his annual look at IP address allocation and assignment statistics.

Addressing 2012: Another One Bites the Dust (copy)

Plenty of numbers in the report to take a look at… Notably, we saw ARIN’s 2012 (45 million) allocation rate increase back to its 2010 rate after falling dramatically in 2011 (23.5 million). RIPE allocated its last IPv4 blocks under its “regular” allocation scheme in mid-September 2012 and moved into the IPv4 exhaustion phase of allocations. In the RIPE region, there wasn’t an apparent “run-on-the-bank” increase in the allocation rate as the registry moved into the exhaustion phase.

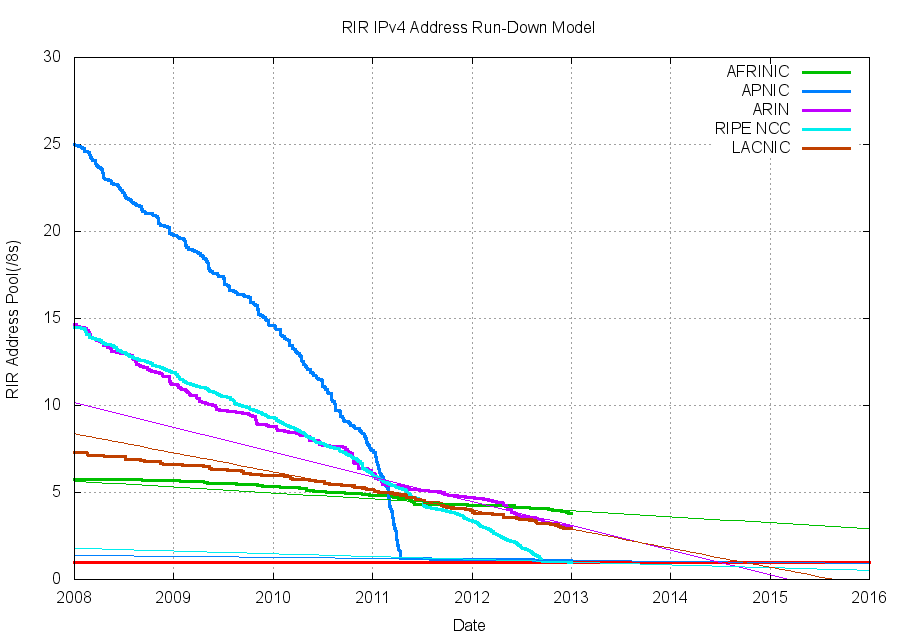

Here Geoff’s updated RIR Address Exhaustion Model shows ARIN moving into the exhaustion phase in mid-2014 with LACNIC in late 2014. AFRINIC’s trend-line currently points to an exhaustion point 9 years from January 2013.

Another interesting statistic found in the report is that the total number of smart phones and tablets purchased during 2012 amounts to almost 779 million units. If each of those devices used a native IPv4 address that would use up 21% of the total IPv4 address space.

Geoff finishes the report with a somewhat pessimistic outlook for the Internet industry.

We are witnessing an industry that is no longer using technical innovation, openness and diversification as its primary means of propulsion. The widespread use of NATs limit the technical substrate of the Internet to a very restricted model of simple client/server interactions using TCP and UDP. The use of NATs force the interactions into client-initiated transactions, and the model of an open network with considerable flexibility in the way in which communications took place is no longer being sustained. Today’s internet is serviced by a far smaller number of very large players, each of whom appear to be assuming a very strong position within their respective markets. The drivers for such larger players tend towards risk aversion, conservatism and increased levels of control across their scope of operation. The same trends of market aggregation are now appearing in content provision, where a small number of content providers are exerting a dominant position across the entire Internet.

This changing makeup of the Internet industry has quite profound implications in terms of network neutrality, the separation of functions of carriage and service provision, investment profiles and expectations of risk and returns on infrastructure investments, and on the openness of the Internet itself.